Surviving Your First Year as a Trader: The 9 Key Principles We Teach at Gulf Education and Financial Services

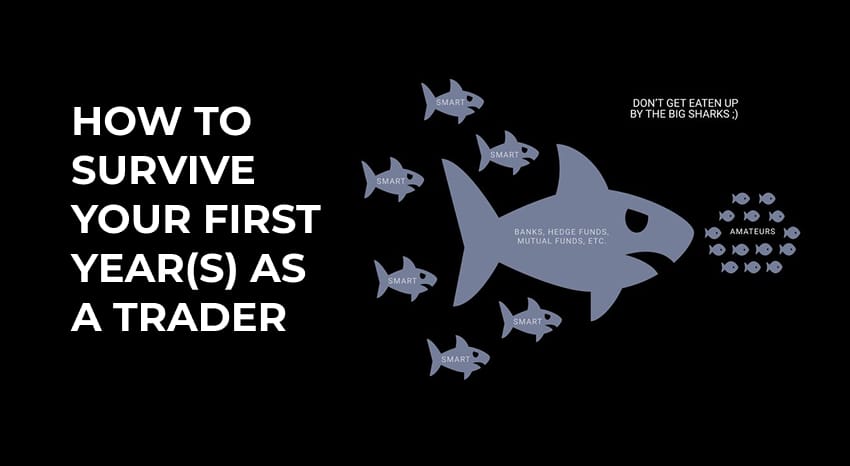

At GULF EUDCATION AND FINANCIAL SERVICES, we don’t believe in sugar coating the reality of trading. From our experience and industry data, we know trading is challenging. Statistics show that 40% of traders quit after just one month, and only 7% remain active after five years. So, why is trading so difficult? Why do so many aspiring traders struggle? The answer lies in mastering nine key principles that we teach our students. These principles not only help you navigate your first year but also set the foundation for long-term success in trading.

1. SETTING REALISTIC EXPECTATIONS

Many beginners ask, “How long will it take to turn $1,000 into $1,000,000?” This is the wrong question. Instead, you should be asking, “How can I avoid losing all my money?” At Gulf Education, we emphasize the importance of realistic expectations. Your first year isn’t about making a fortune; it’s about survival. If you can trade at breakeven and not lose money, you’re already ahead of 99% of traders. Wrong expectations often lead to frustration and early quitting. Instead of focusing on quick wealth, focus on developing a process. The money will follow with time and discipline.

2. WHAT TO FOCUS ON IN YOUR FIRST YEAR

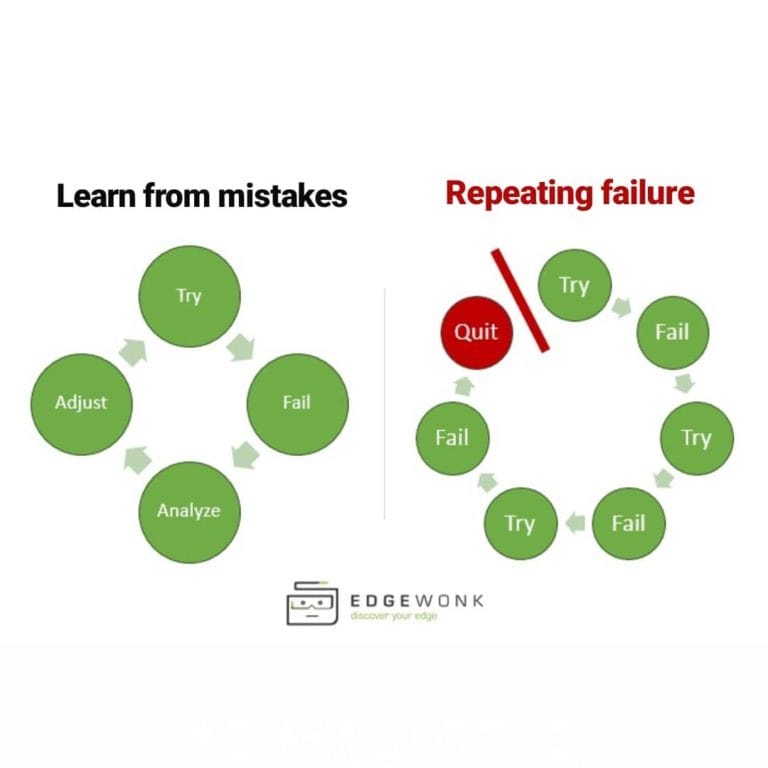

If you’re not making money immediately, what should you do? Learn, observe, and develop a structured approach. At Gulf Education, we guide our students to find one solid trading method and master it. Many traders fail because they constantly switch strategies (system hopping). Instead, commit to one strategy and refine it over time. Success in trading is not about gambling or chasing shortcuts. It’s about building the right mindset and sticking to a process.

3. UNDERSTANDING LOSSES

One of the biggest psychological challenges traders face is handling losses. We teach our students that losses are a natural part of trading. However, there are two types of losses:

- Normal losses: When you followed your strategy correctly, but the market didn’t go your way.

- Dumb losses: When you made mistakes, ignored your rules, or acted on emotions.

Recognizing this difference is crucial. Many traders blame their system, but often, the issue is their own discipline and execution.

4. IS IT EVER TOO LATE TO START TRADING?

One of the most common concerns we hear is, “Am I too late to start trading?” The truth is, trading is not about age—it’s about mindset. If you rush in with unrealistic expectations, you’ll take excessive risks and make costly mistakes. At Gulf Education, we help students develop a patient, structured approach that prioritizes longevity over quick wins.

5. MASTERING YOUR TOOLS

A common mistake we see is traders using indicators and tools without fully understanding them. At Gulf Education, we stress the importance of mastering your trading system before making changes. We recommend sticking with one method for 6–9 months before considering adjustments. The best traders deeply understand their tools instead of jumping from one system to another.

6. FINDING THE RIGHT MENTOR

Mentors can be invaluable—but not all are genuine. The internet is full of so-called “gurus” making unrealistic promises about effortless profits. At Gulf Education, we provide mentorship that focuses on the fundamentals:

- Trading psychology

- Long-term success strategies

- Avoiding common beginner mistakes

- Developing your own personalized trading system

We also encourage our students to engage in trading communities, where they can learn and grow with like-minded traders in a structured environment.

7. HOW TO CONTINUOUSLY IMPROVE

Ask yourself:

- Do you remember your last 10 trades?

- Do you know what mistakes cost you the most money?

- Are you tracking your trading performance?

If the answer is “no,” you need a trading journal. At Gulf Education, we teach our students how to use trading journals effectively. Keeping records of past trades helps you analyze patterns, identify mistakes, and improve decision-making.

8. KNOWING WHAT TO DO VS. ACTUALLY DOING IT

Most people know what they should be doing, but few actually do it. Successful traders develop discipline. This includes:

- Journaling trades

- Analyzing performance

- Avoiding impulsive decisions

We encourage students to dedicate at least 30 minutes daily to improving their trading discipline.

9. THE ROLE OF DEMO TRADING

Demo trading is an essential first step in understanding market mechanics and testing strategies. However, staying on demo too long can be a problem. Demo trading doesn’t teach emotional discipline. That’s why we recommend transitioning to a small live account once you’re comfortable with the basics. This helps develop real-world trading skills without taking excessive risks.

THE FIRST RULE OF TRADING: PROTECT YOUR CAPITAL

At Gulf Education and Financial Services, we teach our students that protecting their trading capital is their top priority. Many new traders focus on future profits without ensuring they have a solid foundation to sustain their journey. Remember: staying in the game is the real challenge. If you burn through account after account, you’ll eventually give up – not because trading is impossible, but because you didn’t approach it the right way. We’re here to help you navigate these challenges, avoid common pitfalls, and build a long-term, sustainable trading career. Join us at Gulf Education and Financial Services, and let’s build your future in trading the right way!