THE TRUTH ABOUT TRADING BOTS: WHAT WORKS AND WHAT DOESN’T

At Gulf Education and Financial Services, we are committed to providing traders with the best educational resources to make informed decisions. If you’ve ever considered using a trading bot to automate your strategy, this article will help you understand what works, what doesn’t, and how to avoid costly mistakes.

WHY MOST TRADING BOTS FAIL

Many traders invest in automated trading bots expecting consistent profits, only to end up with disappointing results. Here’s why most bots fail:

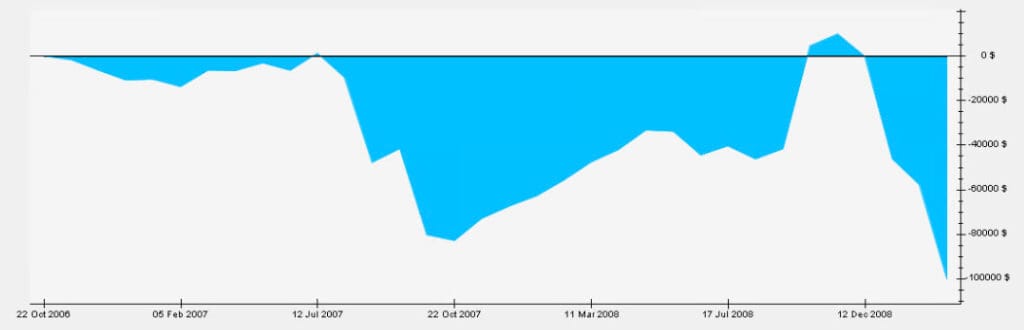

- Over-optimization: Many bots are designed to perform well in specific market conditions but fail in others. They may show promising backtests over short periods but struggle in live markets.

- Mismatch with trader personality: A bot with a high-risk strategy may not be suitable for traders who prefer low drawdowns, leading them to abandon it before it can recover losses.

- Poor instructions: Many bots come with unclear setup guides, making it difficult to configure them correctly, leading to inefficiencies.

- Potential fraud: Some bot sellers manipulate performance records, such as using photoshopped graphs or misleading backtest results, to make their products look better than they really are.

TRADING BOTS THAT ACTUALLY WORK

While fully automated third-party bots are often unreliable, certain types of trading bots can be effective:

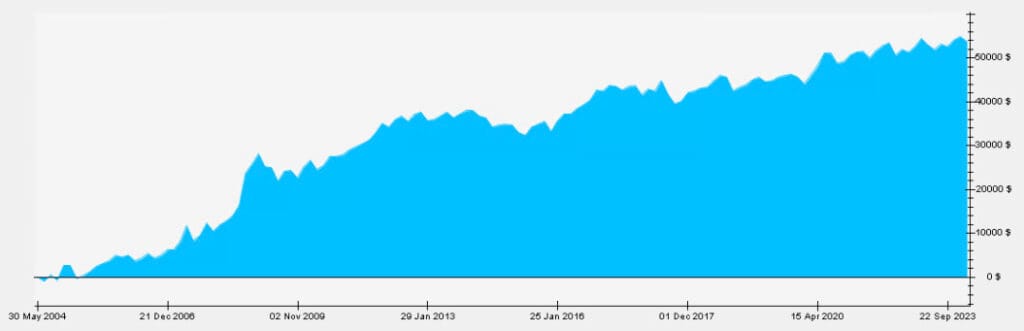

- Self-built bots

- Developing your own bot ensures you understand its logic and strategy.

- You can customize it to match your trading style and risk tolerance.

- Hiring a professional developer to automate a well-tested manual strategy can be a smart approach.

- Mentor-assisted trading robots

- Some experienced traders develop bots that they personally use.

- A reliable mentor should provide clear explanations of the bot’s strategy and guide you on its proper usage.

- Be cautious of any mentor who refuses to disclose details about how the bot works.

- Partial automation bots

- These bots automate specific parts of trading, such as entry, exit, or trade management.

- Exit automation (e.g., trailing stops) can help maximize profits while keeping traders in control of the overall strategy.

- This approach balances the efficiency of automation with the flexibility of manual trading.

HOW TO FIND A RELIABLE TRADING BOT

If you’re interested in automated trading, here are the best ways to find or create a bot that actually works:

- Develop your own strategy: A manual trading strategy that is consistently profitable can be automated with the help of a skilled programmer.

- Use partial automation solutions: Rather than fully automating your trades, look for tools that help with risk management, entries, and exits.

- Find a trusted mentor: If you choose to use a third-party bot, work with someone you trust who has a proven track record of success and is transparent about the bot’s workings.

At Gulf Education and Financial Services, we emphasize the importance of education in making sound trading decisions. While trading bots can assist in execution, relying entirely on third-party automation is risky. The key to success is understanding the logic behind any strategy you use. By staying informed and cautious, you can avoid common pitfalls and use automation wisely to enhance your trading experience.